����һ�� ��Ч�г���˵���������ģ����

����

������Ч�г���˵��ָ��ص���Ϣ�������Ť������֤ȯ�۸��еõ���ַ�ӳ���г�������Ч�ġ����仰˵���ܹ���Ч�����þ��á����ڵȸ�������Ϣ���ʱ��г������� “��Ч���г�”��������㣬�е��˾Ͱ��г���Ч�ʣ���Ϊ��Ϣ����Ч�ʣ���֤ȯ�۸����Ϣ�ķ�ӳ��

������������Ч�ʵ��г�����Ϊ֤ȯ�۸��ַ�ӳ���пɻ�õ���Ϣ��

������������Ϣ���ڵ��������Ͱ���Ч�г���Ϊ���ࡣ��Ϣ����������Ϊ:( 1) ��ȥ����Ϣ��ͨ��ָ֤ȯ��ȥ�ļ۸�ͳɽ��� ( 2) ���пɹ����õ�����Ϣ ( 3) ���п�֪����Ϣ��������ΪͶ�ʴ������˽����Ļ��Ϣ��

��������������Ϣ�������Ӧ����Ч�г���˵���Է�Ϊ������̬: ( 1) ��ʽ��Ч�г���˵ ( weak Form efficiency) �ü�˵��Ϊ����ʽ��Ч������£��г��۸��ѳ�ַ�Ӧ�����й�ȥ��ʷ��֤ȯ�۸���Ϣ ( 2) ��ǿʽ��Ч�г���˵ ( Semi—Strong Form Efficiency) ( 3) ǿʽ��Ч�г���˵( Strong Form of Efficiency Market) ��ǿʽ��Ч�г���˵��Ϊ�۸��ѳ�ֵط�Ӧ�����й��ڹ�˾Ӫ�˵���Ϣ����Щ��Ϣ���������Ļ��ڲ�δ��������Ϣ��

����“�������”( random walk) ��ָ���ڹ�ȥ�ı��֣���Ԥ�⽫���ķ�չ����ͷ�����һ����Ӧ�õ������ϣ�����ζ�Ź�Ʊ�۸�Ķ������Ʋ���Ԥ֪����ʱһ�м����Է����������õġ�����ʽ��Ч�Ĺ�Ʊ�г����Ʊ�۸���ֳ�������ߵ������� ����ѧ��ʽ�ɱ�ʾΪ: yt= a +yt �� 1+ εt���� ytΪ���ڹ�Ʊ���棬yt �� 1Ϊ�ͺ�һ�ڹ�Ʊ���棬εt Ϊ����Ŷ����ʾ���ڹ�Ʊ�������ͺ�һ�ڵIJ�ֵ���� εt ����ͬ�ֲ���E ( εt)= 0��Var ( εt) = ?2�ȶ���ʱ�����й���Ҫ���������һ�Ͷ��أ� ������������߹��̣���Ȼ E ( yt) = �������� Var ( yt) = t?2��ʱ�� t �ĺ������� t ���������ʱ��t?2Ҳ���������

��������ʵ֤����

����ѡȡ2010 ��7 ��22 ����2013 ��6 ��1 ���Ϻ�֤ȯ������ A ��ָ���ĵ�������ֵ���� 689 ��������Ϊ�о�����ʱ�����������Ƿ�����������ģ�ͽ��з��������� A �ɸ��ɹɼ۵������� A ��ָ���������м�ǿ������ԣ�����ͨ���� A ��ָ���о����ý��ۣ����Է�ӳ A �ɹ�Ʊ�����������

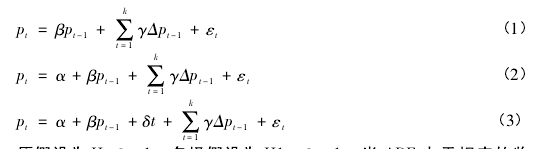

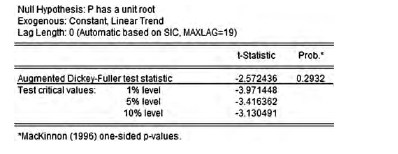

����( 1) ���о�ģ���У�������ָ����Ϊpt����һ�ײ�ּ�Ϊ��pt=pt��pt ��1����ʱ������ { Pt} �� ADF ��λ�������һ����ʽΪ:��1��

����

����ԭ����Ϊ H0:β =1���������Ϊ H1: β �� 1���� ADF ������Ӧ���ٽ�ֵʱ�����ܾܾ�ԭ���裬��ζ������ { Pt} ��ƽ�ȣ����е�λ��; ������Ϊ���� { Pt} ��ƽ�����У�������λ�������Ѽ�������������ģ�� ( 3) ���м��飬������¡�2��

����

����ͬ����ģ�� ( 2) ��ģ�� ( 1) ���м���õ�����ģ�Ͷ����ܾܾ�ԭ���裬˵�� A ��ָ�����̼��е�λ����������֤�ҹ��Ͻ��� A ���г�����������߹��ɡ�

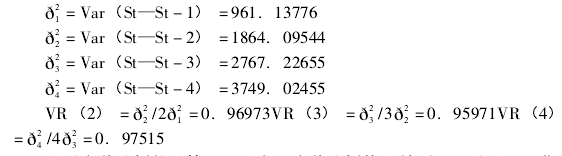

����( 2) �����������һ��/q �μ����ֵķ���ֱ�������: ?21= Var ( St—St �� 1) ?2q= Var ( St—St �� q) ���巽���������: V�� ( q) = ?2q/ q?21������ݷ������������������ô V�� ( q) ֵӦ�ý����� 1�� ����MATLAB������������:��3��

����

����ͨ����������ļ��㣬���Է��ַ������ֵ�ܽӽ� 1������ A ��ָ�����̼۷���������ߡ�

����( 3) �γ̼����γ̾��ǹ�Ʊ�۸�仯������ͬ���ŵ����С���Ʊ�۸�仯ֻ������: ����������۸�仯����۸�仯���ֵĸ��ʷdz�С���ʿ�����۸�仯��Ϊ���ļ۸�仯��

�������㹫ʽ����: E ( m) =2n1n2/ N + 1 Var ( m) = 2n1n2( 2n1n2 ��n1 �� n2) / �� N2 ( N �� 1) ) �����У�n1 �����������仯������n2 �Ǹ��������仯������N Ϊ����������m ���γ�����Var ( m) �� m �ķ�����鲽��: ( 1) ԭ���� H0: ����Ϊ�������; ������� H1: �����������������

����( 2) ����ͳ���� Z = m �� E ( m) /Var ( m)0�� 5����֪ Z ���ӱ���̬�ֲ� N ( 0��1) ������������ Z �ľ���ֵ�����ٽ�ֵ����ܾ�ԭ���� H0�����ɼ۱仯�����������; ��֮�������ԭ���� H0�����Ϲɼ۷���������ߡ�

����������������� MATLAB ����õ�: E ( m) = 343�� 325��Var( m) =170�� 079 Z = ��0�� 9367729��ȡ������ˮƽ a =0�� 05������̬�ֲ������ٽ�ֵ�� Za= 1�� 96�����Ծܾ�ԭ���裬���ҹ��Ͻ��� A ���г�����������ߡ�

������������

����������ʵ֤���������֪�����ּ��鷨�ļ���������ζ���Ͻ���A ������ʱ���������ݵ���������������ģ�ͣ����������жϳ����г�Ϊ��ʽ��Ч�г���˵�������п����ҹ�ȥ��Ϣ�����ֹ��в���ģʽ����ͼԤ��۸�仯��Ŭ������Ͷ��ѧ�г�֮Ϊ���������Ĺ����Dz����гɹ��ġ�һ�����Ե�Ͷ��������ʶ����Ʊ�������������ߵĹ����£�Ӧ���Ǹ����Լ��Է��յ�ƫ�ó̶ȼ��������棬ѡ����ѵ����桢������� ( ֤ȯͶ�����) ��ʹ�Լ���Ч�ôﵽ���

����

���������

������1�� Fama�� Efficent capital market s: a rev iew o f theory and empiricalwork ��J�ݣ� Journal o f Finance��1970 ( 25) : 383 �� 417

������2�� ��С�ޣ����ڳɣ� �����ҹ��ڻ��г���ʽ��Ч�Ե��о� ��J�ݣ���������ѧ����2007 ( 01) : 145 ��147

������3�� ��ΰ������У� ��Ϊ����ѧ�о����� ��J�ݣ� �������磬2006( 09) : 155 ��167